SALES TRANSFORMATION

The secret to making it in the digital sales world: The human touch

Twenty years ago—let’s call it the monochannel era—B2B sellers typically had one channel for all their customers. It might have been a face-to-face sales force or a call center, or they might have sold solely through resellers or distributors. As businesses grew and connectivity increased, these companies might have added a new channel; customers would have been clearly assigned to one or the other based on their segmentation.

Then the internet changed everything. Multiple channels were available to customers in any segment. Monochannel became multichannel, and now we have omnichannel—a “multitouch” world. Today’s customers, regardless of segment, expect to engage with companies using the channel of their choice at any given moment in time and at all the different stages of the buying process .

|

The evolution of the sales approach to customers Phase 1: Mono-channel (pre-internet) |

||||

| Face-to-face | ||||

|

Phase 2: Multiple channels (pre-internet) |

||||

| Segment 1 | Segment 2 | Segment 3 | ||

| Inside | Face-to-face | Key account management (KAM) | ||

| Phase 3: Multi-channel (internet) | ||||

| Segment 1 | Segment 2 | Segment 3 | ||

| KAM | ||||

| Face-to-face | Specialist | |||

| Reseller | Partner | Sponsors | ||

| Inside/telesales | ||||

| Web sales | ||||

| Backbone | ||||

When customers are researching a new product or a service, for example, two-thirds of those who lean more towards digital still want human interaction. As customers move into the evaluation and active-consideration stages, digital tools that provide information, such as a comparison tool or online configurator, come into their own, especially when combined with a highly skilled sales force.

After the purchase, when discussions are about renewal, cross-selling, and upselling, the tables are turned completely, and 85 percent of those who lean overall towards human interaction now prefer digital. Yet most B2B companies still reward reps more for spending time keeping customers loyal and repurchasing than for uncovering new customer needs or driving demand, which is exactly where customers say they want face-to-face expertise. The key message for sellers is that context matters more than customer type and much more than industry. Companies that are digital from start to finish today could see even higher growth if they reintroduce the human touch to the start of the buying journey. Conversely, if companies are firmly holding customers’ hands via key-account managers or value-added resellers, they should be aware that customers are saying loudly and clearly that they don’t value that close personal attention after the sale.

What do customers want?

Customers want a great digital experience and a great human experience. Be careful, though. We asked customers “What annoys you most?” and gave them a large number of possible answers, including price. A third said “Too much contact”—by far the single biggest answer.

The trick is to understand where human interaction is most wanted and invest there—be it in expertise available via a web chat, ensuring a speedy response to customer-service queries, or simply having a person pick up the phone when a potential customer rings.

Companies also need to invest in digital, but those investments should focus on two places. First, where digital is most valued by customers: enabling speedy purchases and repurchases, delivering online tools for customer service, or offering real-time pricing with product configurators. Second, where digital can enable humans to do a better job of interacting with customers when the human touch is required.

Since many B2B customers still want human interaction at some stage of their customer journey, sellers need to offer multiple routes to market with both human and digital resources available at all stages at varying degrees of intensity. The challenge is ensuring seamless transitions and handoffs from one stage to the next so that customers are neither repeating themselves nor frustrated at delays.

The implications for employees are substantial. Sales reps need to focus their efforts on expertise, on being more consultative, and on responding quickly. Compensation structures may well have to change, too. If reps become less important at the point of purchase, then the commission model will need to evolve.

From our research and experience, three traits have emerged that should be core ingredients of every company’s optimal human-digital blend: speed, transparency, and expertise.

The need for speed

Slow turnaround times are frustrating, and slow means more than 24 hours, even for B2B customers. Companies need to think about having 24-hour expertise available on call, with super experts, who can answer customer questions in real time, sitting with the sales or customer-service team. Digitally enabled tools can help enormously, for example by connecting customers with experts via a web chat.

Even when customers are doing extensive online research, there usually comes a point when they want a question answered quickly. This could be online, through the company website’s FAQs or product pages, or through contact with a real person. Yet most B2B companies have yet to perfect their online content to answer all questions, and even fewer have reconfigured their traditional inside sales channels or web-chat tools to deliver highly technical expertise on demand.

Once customers are set on making a purchase, they want to do it fast. One-click purchases or shortcuts for repeat orders (even for large capital purchases) can speed up the process tremendously. If customers are on a company’s website but have to buy from a distributor, they need to be able to reach the appropriate page on the distributor’s website quickly and smoothly. If there are changes to the RFP, customers expect an almost instantaneous turnaround or, better still, an online space where buyer and seller can solve the problems in real time. Customers we spoke to complained a lot about being unable to make a quick change, whether they were buying in person or digitally.

Finally, speed is vital in repurchase and post-purchase troubleshooting. Four times as many B2B buyers would buy directly from suppliers’ websites if that option were available (and fast). They are especially keen on it for repeat purchases.

For postpurchase needs, speed can come from something as simple as having better FAQs, or from a well-run forum where customers can solve one another’s problems online. Increasingly, it means using chat bots, which can often answer a lot of customers’ queries, or at least ensure they are directed to the best place or person as quickly as possible.

One B2B retailer changed how it offers online support by crowdsourcing improvements to its FAQs and offering a small reward as an incentive to engage. It also interviewed customer-facing staff to prioritize customers’ pain points. It then updated the FAQs based on this feedback and cross- referenced the answers with the service calls that had the highest-rated resolutions to ensure the content was correct. Finally, and perhaps most simply of all, the company moved the FAQs to a more prominent place on its e-commerce site.

These relatively inexpensive and straightforward changes reduced the volume of calls and messages to its customer care center by a staggering 90 percent, since customers could now quickly find the answers to their problems. This success allowed the retailer to shift support capacity to work with the key- account teams on strategic accounts.

Transparency matters

Customers want transparency. They want to know at a glance the difference between what they have today and what they could have tomorrow, and they want to know what the total cost is. Digital tools make product comparison and price transparency easy and can be used both by customers directly and by sales reps working with clients, blending the digital and human. For example, in more transactional situations or for general comparison and evaluation, customers want to be able to look online for pricing or use configurators to generate pricing for comparisons. In more complex or consultative situations, face-to-face or inside sales reps might access online configurators or pricing tools in collaboration with a customer.

The importance of transparency extends to resellers. Our research shows that customers still judge companies on pricing transparency at their resellers. If the reseller lacks a good product-comparison engine, a good configurator, easy-to-understand pricing, or easy-to-build quotations, then in the customer’s mind it’s the same as if the company was managing the sales process itself. One option is to let customers use your site to do their comparisons; the other is to find out where customers struggle on the reseller’s site and invest in helping the reseller overcome the problem.

Whatever the specific situation, it is critical to control as much of the process as you can, and to influence what you cannot directly control. One software company realized it wasn’t converting small- and medium-sized business customers from consideration to purchase. Its one-size-fits-all approach to product recommendations meant that SMB customers saw the same offers as enterprise-level customers and thus had no clarity on which elements might be priced differently if applied to them. So they took their business elsewhere. It was time for a change.

The company set up a “trial and buy” website specifically geared to small- and medium- size businesses. It asked customers to fill in a brief form to assess their needs and made offers based on their answers, with clear pricing for each package and a clear explanation of how each package was different. This approach helped the company open up a whole new segment. Within three months, 90 percent of SMB buyers were first-time customers. Those customers whose needs were seemingly too complex for an off-the-shelf package were routed to a team of inside sales experts who were able either to direct them to the right standard package or to configure a solution to meet their needs. This ability to “triage” customers into those who need more human help versus those who can be well served with digital tools can significantly improve customer experience and conversion.

Digital to support your experts

Today’s account managers needs to be experts, and digital tools can help them provide their expertise to their customers. The human conversation facilitates and drives the customization, while the digital tools bring the quick visualization and specifications— including pricing tradeoffs—into sharp relief. Neither works without the other.

A senior account manager at an audiovisual company was sitting down with a customer’s team. On her tablet was a product configurator, and during a three-hour meeting, she was able to use the live configurator to redesign the product in line with the customer’s evolving requirements. The pricing updated in real time, the ancillary products and services that would complement the new system were included, and everyone around the table could talk about what they were seeing on the tablet. Such an exchange might have taken two to three weeks just a few years ago.

At a medical-products company, sales reps brought their expertise to surgeons, helped by a complex configurator and visualization tool. They were able to help the surgeons pick precisely the right product for particular patient segments (based on demographics and diagnosis) and show them a video game that demonstrated connecting the device to the patient. This experience boosted surgeon satisfaction with the company by 10 percent, and sales by 12 percent. Moreover, the surgeons rated the reps’ expertise as 30 percent better than that of a control group armed with just brochures and PowerPoint.

The hat trick

Successfully bringing speed, transparency and expertise into the digital/human blend delights customers and grows sales. Recent moves by Grainger, are a classic example of a response to all three customer needs simultaneously.

Grainger is one of the world’s largest providers of maintenance and repair supplies and was one of the first companies in its sector to seize upon digital as a tool for achieving both customer intimacy and growth. As far back as 1991, when they provided an e-catalog on CD-ROM, Grainger has been at the forefront of embracing digital alongside its core “human” branches and sales reps. Fast-forward to today, when 69 percent of Grainger orders originate via a digitally enabled channel (such as website,TakeStock, and EDI). But sales and service representatives, along with local branches, remain integral to the customer experience.

As their ecosystem evolves, Grainger continues to innovate, launching two businesses that are fully online only. Monotaro, serving SMBs in the Japan market, and Zoro Tools, serving SMBs in the United States, are both single-channel online stores. Both offer only products that are meaningful for this segment, which meant whittling down tens of thousands of SKUs, simplifying the assortment available, and increasing the speed at which customers find what they need. Pricing is transparent, and the purchase process is fast: simply click to buy.

The benefits for Grainger have been significant. Both Monotaro and Zoro have experienced double- digit growth as the result of a speedy, transparent, and informative process (22 percent and 18 percent respectively, 2017 over 2016). Simultaneously, customers continue to engage in analog experiences, with 32 percent picking up orders either at a branch or via an onsite locker system.3 The human touch and experience remain very relevant.

Perhaps the single biggest lesson from this research is the benefit of asking customers what they want. We asked them, “What’s the one thing a salesperson could do that you would really appreciate in terms of how you interact?” Their answer: “Ask me.”

Is it time to ask your customers whether the monthly meetings you have with them are valuable? Would they prefer a quick text or email rather than a phone call? Are they aware of the product wiki you have online? Get the customer involved to find out when to use digital tools and when they want the human touch.

When B2B buyers want to go digital and when they don’t

| Only a small proportion of B2B buyers need inperson support when making a simple repeat purchase. |

| When buyers find it helpful to speak with someone,1 % of respondents |

| Never—always prefer digital | 4 | ||||

| Same product or service as before | 15 | ||||

| Previously purchased product or service but with different specifications | 52 | ||||

| Completely new product or service | 76 | ||||

When it comes to actually making a purchase, 46 percent of buyers say they would be willing to buy from a supplier’s website if the option were available and the service efficient. That compares with just 10 percent who make an online B2B purchase today.

The importance of an efficient service relates to the second finding: the way the experiences of B2B buyers in the online consumer world has influenced their expectations. Be they online or off, B2B buyers want an immediate response. They want ease of use (the ability to find the information they need effortlessly). And they want that information to be both accurate and highly relevant to their particular needs, wherever they are on the customer decision journey.

Noteworthy too is how often they are dissatisfied with suppliers’ current level of digital and offline performance: some 46 percent of survey respondents said it was difficult to compare products online accurately. They are frustrated that they cannot complete a repeat order easily. And they grumble about the time it takes to get a response when seeking help.

Indeed, slow response times are by far the biggest frustration for buyers, bigger even than pricing issues. Some 30 percent of buyers of industrial technology, for example, said they preferred to buy from distributors because manufacturers’ sales representatives took too long to get back to them. That is not to say that all distributors outperform suppliers, but it illustrates how a slow response risks lost sales. After the sale, the four most commonly identified pain points that would prompt a buyer to con- sider an alternative supplier all relate to suppliers’ lack of responsiveness.

| A slow response time is buyers’ biggest complaint. |

| What frustrates buyers most, % of respondents |

| Slow response time | 40 | |||||

| Pricing issues | 19 | |||||

| Poor technical or product knowledge | 14 | |||||

| Lack of face-to-face or phone interaction | 13 | |||||

| Lack of online capabilities | 7 | |||||

| Poor comparison capabilities | 7 | |||||

The implications

The survey findings suggest the need for two different sets of digital investments.

Customer-facing investments

The first set targets those who are comfortable or even prefer being online, keeping them satisfied and loyal, speeding up the sale, and encouraging them to spend more.

For instance, comparison engines will help ensure that buyers consider suppliers’ products and services in initial searches and give them easy access to information. Click-to-chat support on company websites will offer buyers the assistance they expect around the clock. And automatic email reminders will drive repeat purchases. (Half of all B2B buyers rely on sellers to remind them when to reorder, according to our survey, but many sellers disappoint.)

| A slow response risks losing customers to competitors |

| Why, after making a purchase, buyers might look for a different supplier, % of respondents1 |

| Can’t get quick answer to troubleshooting question | 42 | |||||

| Reorders are not timely | 32 | |||||

| Sales representative only follows up when asked | 31 | |||||

| Customer-service representative unavailable when needed | 27 | |||||

| Sales representative is in touch too frequently by phone or in person | 10 | |||||

| Sales representative is too often in touch digitally | 6 | |||||

B2B buyers rely on sellers to remind them when to reorder, according to our survey, but many sellers disappoint.)

Some companies provide direct online sales, perhaps with an automated next-product- to-buy engine based on customer-transaction data. An advanced-materials and- machinery company we know tripled market revenue growth in this way. Direct sales are not an option for all, yet even those suppliers that sell indirectly will have to work with distribution partners to facilitate online purchases if growth is their goal.

Whatever the functionality, it will have to meet expectations for speed set in the B2C world. “There’s no sense having an e-chat function that I have to wait in a 15-minute queue to use,” one buyer told us. “I want it now, or I’m logging out and going elsewhere.”

Sales-force investments

The overwhelming majority of buyers told us they still want the prompt attention and expertise of a salesperson when making decisions about first-time purchases. Investments in digital assets will indirectly help the sales force meet those needs, freeing them up from dealing with routine inquiries (when customers don’t want to talk to them anyway). Instead, they can devote time to helping customers with more complex buying needs, as well as seeking out new customers. However, a second set of digital investments will help the sales force directly.

Relatively simple customer-relationship-management tools can track customers’ previous questions and help anticipate needs. Virtual product demonstrations on a browser or tablet (when visiting a buyer) will assist in a sale. Customer-segmentation and value-proposition engines help sales representatives build tailored offers in the field that quantify the value for the customer. And as in the online world, advanced analytics can prompt buy recommendations. They can even feed sales representatives with real-time information on how to price an offer based on an analysis of deals other salespeople in the company have closed.

This is just the start. Suppliers’ digital strategies will have to change in line with evolving customer preferences. But it makes sense for them to cut their teeth in the digital world with investments that reflect customers’ current preferences and expectations.

What sales executives need to get right for digital success

Boosting your sales ROI: How digital and analytics can drive new levels of performance and growth

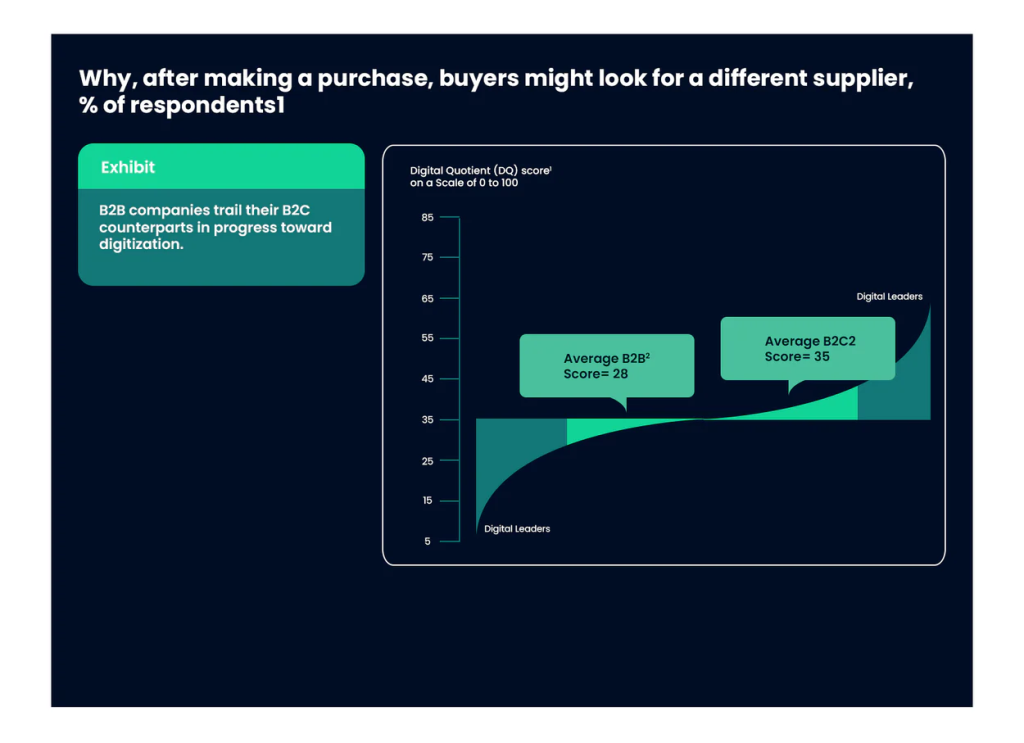

Measuring B2B’s digital gap

This failure is especially acute when customers voice a preference for digital interactions. The data-analytics gap also shows up in B2B companies’ ability to automate decisions. B2C companies were able to automate, and thus better optimize, customer interactions across purchasing journeys, as well as automate their marketing decisions. B2B companies have applied digital automation largely to internal processes rather than to those that are customer facing.

Culture: a firm base. On average, across cultural DQ measures, B2B companies aren’t far behind their average B2C counterparts in core areas such as trust and internal and external agility. Deep-seated cultural barriers, in other words, shouldn’t hold back B2B digitization. There’s a big gap between leaders and laggards, though, and some pain points that stand out. We found that fewer than 15 percent of companies had adopted test-and-learn approaches to new digital business initiatives, and for a third of B2B companies, it takes more than a year to bring a new digital idea to implementation. Many fewer B2C companies require that much delivery time.

As the “consumerization” of B2B proceeds, pressure will grow on leaders to accelerate their digitization efforts. Doing so should help boost effectiveness across the board, and it holds particular promise for companies seeking to raise their omni channel game by putting better tools in the hands of sales teams and striking the right balance between new and traditional channels. Our research suggests that as senior leaders elevate digital as a strategic priority, they can look to B2C companies and industries for inspiration.